-40%

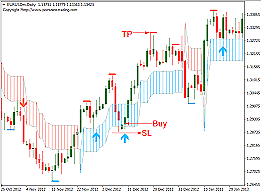

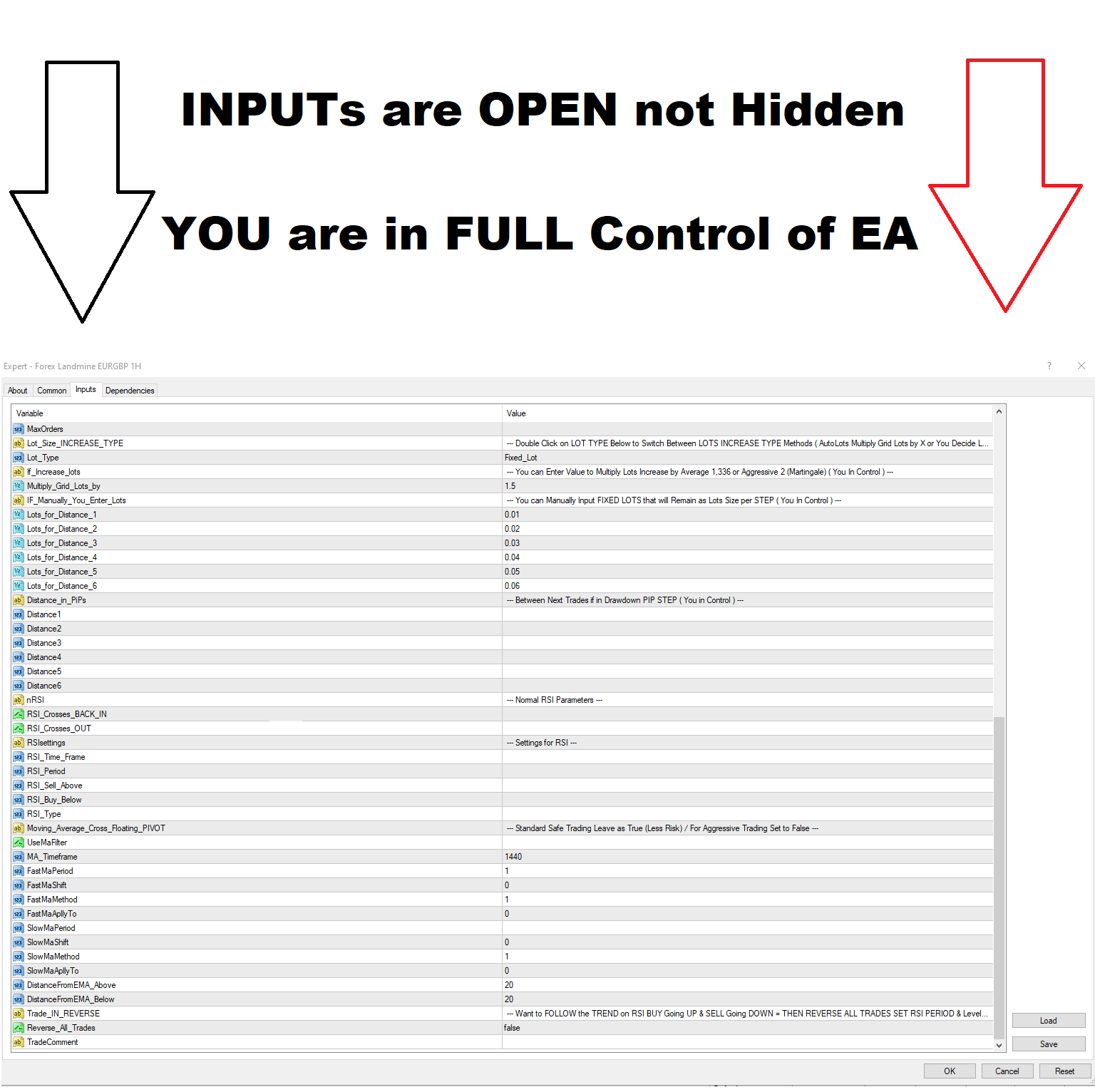

Best Forex Indicator Trading System Mt4 Strategy Trend Profitable No Repaint A++

$ 5.27

- Description

- Size Guide

Description

Swing Tradingis the first indicator designed to detect swings in the direction of the trend and possible reversal swings. It uses the baseline swing trading approach, widely described in trading literature. Its winning ratio is around 80%.

Profit for market swings without getting whipsawed

The indicator displays the trend direction at all times

A colored price band represents the opportunity baseline

Colored dashes represent possible reversal swings

The indicator analyzes its own quality and performance

It implements a multi-timeframe

dashboard

The indicator studies several price and time vectors to track the aggregate trend direction and detects situations in which the market is oversold or overbought and ready to correct.

Customizable trend and swing periods

The indicator is non-repainting or backpainting

Swing trading offers timing and protection against being whipsawed because trends created out of noise or volatility never present swings: for the most part, only established trends present swings.

A brief introductionSwing Trading is a style of trading that attempts to capture gains in a security within one day to a week, although some trades can eventually be kept alive for longer. Swing traders use technical analysis to buy weakness and sell strength, and have the patience to wait for these opportunities to happen, because it makes more sense to buy a security after a wave of selling has occurred rather than getting caught in a sell-off.

The Opportunity BaselineMuch research on historical data has proven that markets suitable for swing trading tend to trade above and below a baseline price band, which is portrayed on the chart by a colored band, calculated using the Average True Range.

The baseline is used by the swing trader, which strategy is

buying normalcy and selling mania

or

shorting normalcy and covering depression

. In absence of exhaustion patterns, the swing trader goes long at the baseline when the stock is heading up and short at the baseline when the stock is on its way down.

Swing traders are not looking to hit the home run with a single trade, they are not concerned about perfect timing to buy a stock exactly at its bottom and sell exactly at its top. In a perfect trading environment, they wait for the stock to hit its baseline and confirm its direction before they make their moves.