-40%

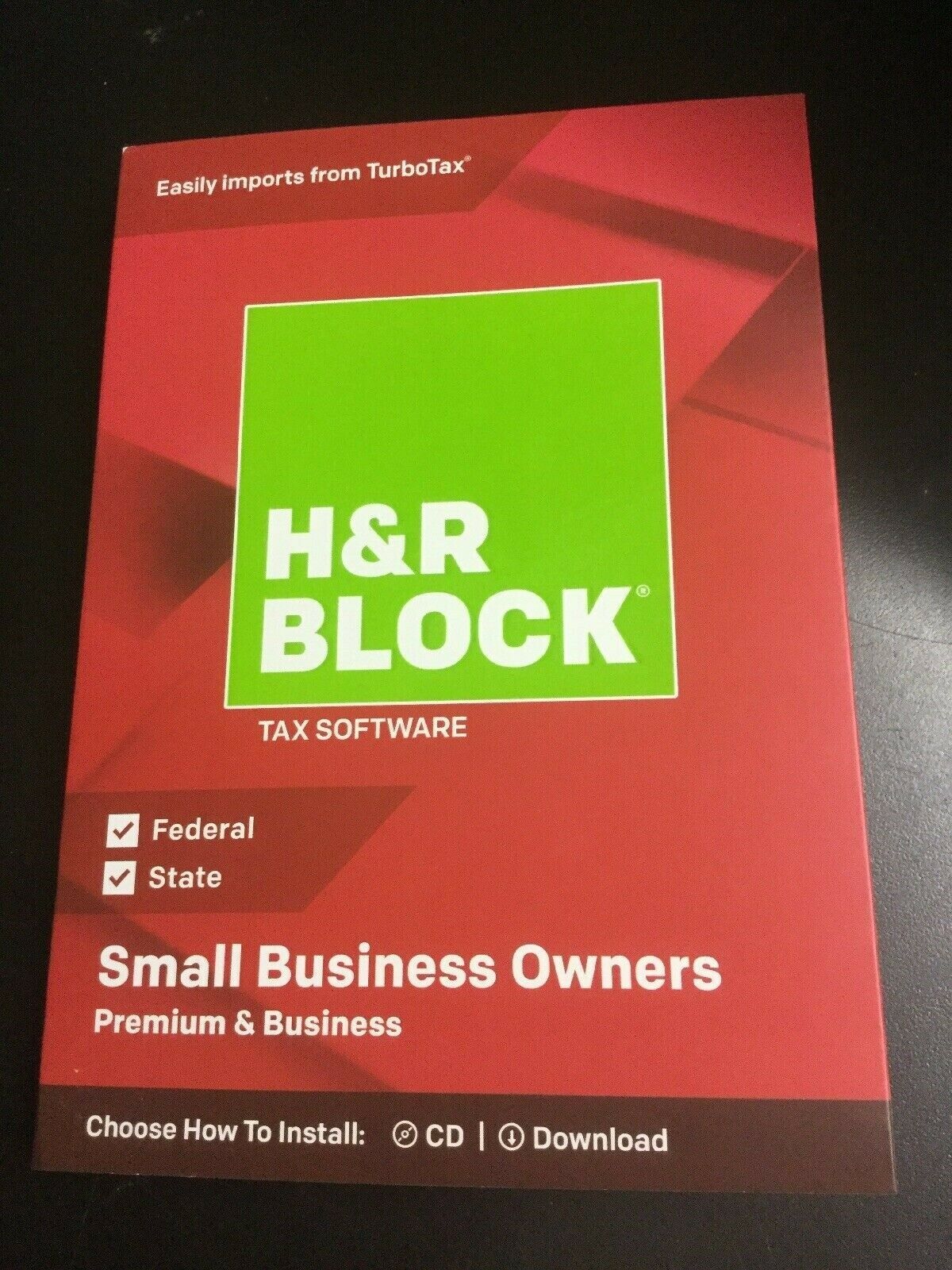

2020 H&R Block Small Business Owners Premium & Business Tax Software FOR WINDOWS

$ 42.22

- Description

- Size Guide

Description

This is a BRAND NEW (FACTORY SEALED) 100% AUTHENTIC!!H&R BLOCK 2020 / Windows 8.1/10

SMALL BUSINESS OWNERS

PREMIUM & BUSINESS TAX SOFTWARE

FEDERAL / 1 STATE

WINDOWS ONLY !!

*PC DOWNLOAD *

**

*

DOWNLOAD VERSION( NO CD INSIDE )**

****

DO NOT BUY THIS SOFTWARE IF YOU DO NOT KNOW HOW TO USE IN OR DONT HOW THE PROPER PC/MAC WITH Operating system storage and all requirements to use this software thank you.

Please see photo for all system requirements for installation and storage and operating system needed

Please confirm you have the correct operating system and will work with the software before purchasing.

FREE SHIP (USPS) MAIL, WITH TRACKING & DELIVERY CONFORMATION

What’s Included

H&R Block Tax Software Premium & Business 2020 (PC Download KEY)

• PRODUCT DESCRIPTION •

H&R BLOCK 20 Small Business Owners Premium & Business Tax Software offers everthing people need to complex federal taxes, state taxes, business taxes and get maximum refund guaranteed. It includes step-by-step guidance on more than 350 credits and deductions, a help center with over 13000 searchable articles, and in-person representation in the unlikely event of an audit. Supports filling tax returns for S corpotations, partnerships, LLCs, nonprofits resources for payroll, employer(W-2 and 1099)forms, and more.

Step-by-step Q&A and guidance

Quickly import your W-2, 1099, 1098, and last year’s personal tax return, even from TurboTax® and Quicken® software

Easily import from TurboTax® and Quicken® software

Itemize deductions with Schedule A

Accuracy Review™ checks for issues and assesses your audit risk3

Five free federal e-files for your personal return, and unlimited federal preparation and printing

Reporting assistance on income from investments, stock options, home sales, and retirement

Guidance on maximizing mortgage interest and real estate tax deductions (Schedule A)

H&R Block DeductionPro® values and optimizes charitable donations (Schedule A)

One state program download included — a .95 value1 (state e-file available for .95 per return)2

Tax calculators to help determine the cost basis of sale, dividend, gift, and inheritance assets

Advanced Schedule C guidance to maximize deductions for self-employment income

Schedule E guidance for rental property income and expenses

Free e-file included for most business forms

Get guidance for, prepare, and file corporate and S-corporation tax returns (Forms 1120, 1120S), partnership and LLC tax returns (Form 1065), estate and trust tax returns (Form 1041), and nonprofit tax returns (Form 990)

Create payroll (940 & 941) and employer (W-2 & 1099) forms

Maximize your tax benefits for vehicle deductions, depreciation, and business expenses

Unlimited business state programs included

1 Additional personal state programs are .95 each. Most personal state programs available in January; release dates vary by state.

2 State e-file not available in NH. E-file fees do not apply to NY state returns.

3 The audit risk assessment (of your personal return) is not a guarantee you will not be audited.

4 Free in-person audit support is available only for clients who purchase and use H&R Block Tax Software to prepare and file their 2020 individual income tax return. Terms and restrictions apply; see hrblock site for details.